Your partner for investments in renewable energies

15 years

track record2 bn €

Investment volume4 of

solar, wind, storage & charging infrastructure1.4 GW

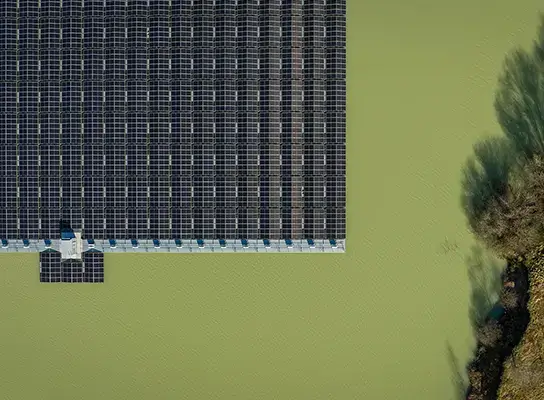

assets under managementre:cap global investors ag is an independent M&A advisor for institutional investors seeking investment opportunities in renewable energies and an asset manager for long-term high-return asset performance. With a team of experts in the renewable energies sector, we have been providing our clients with a broad-based network, in-depth market know-how and forward-looking strategies for over ten years now. Cooperating shoulder-to-shoulder with our partners, we jointly play our part in shaping the energy transition.

In the meantime, we have achieved sustainable growth with solar, wind, battery storage and charging infrastructure in seven European countries. From project development to commercially operating plants, we invest for our clients in all phases of a project. We also support the sale of projects for investors, operators and project developers.

By drawing on the biggest common denominator in our cooperation with our investors and partners, we achieve more! Working with a team of dedicated specialists, we strive to excel a little more each day.

FP Lux European Battery Storage Fund successfully completes first closing

FP Investment Partners and re:cap global investors ag announce the successful first closing of the FP Lux European Battery Storage Fund. Institutional investors from Germany have already made significant commitments to the specialized battery storage fund. The strategy provides pan-European access to attractive investment opportunities in battery storage systems and positions itself as one of the key drivers of the energy transition. FP Investment Partners acts as the fund’s initiator

For a green future

The environmental protection challenges in order to combat climate change have (at last) propelled sustainability into the mainstream. The political initiatives of the UN, the EU and individual countries provide companies with a legal framework for strong “sustainability”, which must conform to classifications, be transparently monitored and documented.

Sustainability is measurable! By means of offsetting through the purchase of CO2 certificates, supplying households with green energy or protecting and promoting biodiversity.

We specialise in high-return and sustainable projects

Based on experience, competence and market expertise, re:cap’s investment advice is the key to our success with

- diversified investment strategies

- high-return transaction advice

- sustainable asset management

For a green future

The environmental protection challenges in order to combat climate change have (at last) propelled sustainability into the mainstream. The political initiatives of the UN, the EU and individual countries provide companies with a legal framework for strong “sustainability”, which must conform to classifications, be transparently monitored and documented.

Sustainability is measurable! By means of offsetting through the purchase of CO2 certificates, supplying households with green energy or protecting and promoting biodiversity.