with re:cap

Services > For Investors

Renewable energies asset class – energy in abundance

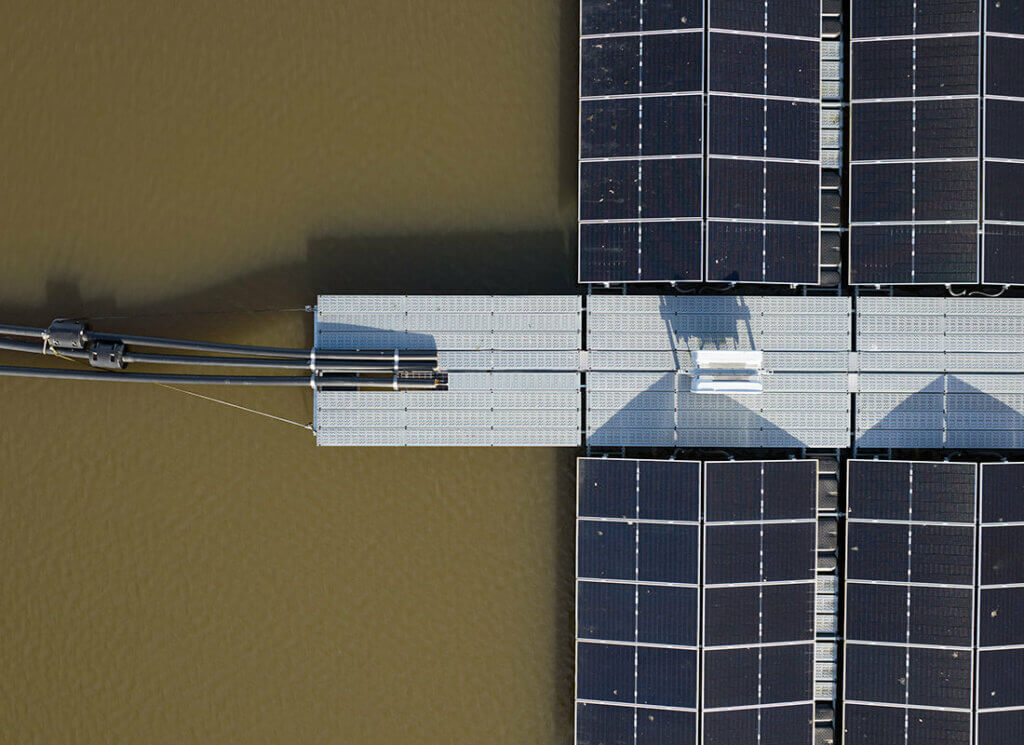

The development towards sustainable energy supply is in full swing. This is central to ensuring a secure, environmentally sound and economically successful future. However, it also means that high investments, especially in solar and wind farms, will continue to be necessary in order to meet the ever-growing energy needs from renewable energy sources.

Portfolio strategy

Renewable energies must fit you like the proverbial glove.

We put together a portfolio for you that is optimised according to risk/return profile, technology and region. In selecting projects, we draw on experts from five nations who continuously analyse the international markets for you.

We focus here on countries that have created a secure investment framework for renewables in recent years and have advanced to the league of OECD countries (or are on the verge of becoming members).

We screen investments in renewable energies with regard to the use of new technologies, assess the attractiveness of the locations and analyse the technical details of the installed components. The success of the energy transition is reflected in technical progress, and we want you to participate in this as well. In addition, we review and optimise the composition of your portfolio at regular intervals and according to the motto: what was good yesterday could become even better tomorrow through a change in allocation.

Portfolio/asset management

One of the cornerstones of our successful and sustainable portfolio management is intelligent IT systems. In 2012, we started optimising our processes with the Dropscan digital mailbox service and amagno document management. Today, we use digital applications in all areas of asset management with the Tagetik financial software suite and the Nispera monitoring platform (link). These systems enable us to monitor the technical and commercial performance of our assets any time at the push of a button and to identify and resolve problems at a very early stage.

Since the systems also work at the portfolio level, we can quickly map the effects of overarching adjustments, for example in the development of electricity prices, in scenarios and agree on optimisations with our investors.

Close cooperation with our transaction team enables companies to adapt quickly depending on their baseline commercial, legal and technical situation. Knowledge from the transactions helps us in ongoing asset management to integrate companies appropriately into our systems from “day 1”. Conversely, we are also able to incorporate the insights from operations back into the evaluation of new transactions.

Market intelligence

“Intelligence is the ability to adapt to change.” (Stephen Hawking)

Nothing is as constant as change – this also applies to markets and technologies. To ensure we are not caught off guard by these changes, we regularly attend training courses, participate in trade fairs and foster an exchange with other market participants such as vendors, banks and insurers. Like this, we always have our eyes and ears close to the market – not least to protect your investment.

Transaction advisory

“Reliable transaction processes at home and abroad are the foundation of any investment success.”

We assist you with professional advisory services at all stages of the transaction, from negotiating the purchase price to drafting a letter of intent and concluding the sale purchase agreement. We select the right banking partner, negotiate the terms and conditions through to closure on your behalf and manage payment of the purchase price. The results of our due diligence processes are incorporated into every agreement. While we collaborate with long-standing partners for the technical and legal aspects (link), we perform the commercial evaluation of the projects ourselves. In recent years, we have managed to build up particular expertise in the area of power purchase agreements (PPAs) and the underlying marketing of electricity.

This enables us to realise transactions with the requisite degree of security, but nevertheless expeditiously. And this is independent of the location: with us, you always have a fixed contact person who accompanies you through to the successful closure of the transaction.

Commercial management

“When investing in a renewable energy project, the transaction is just the first step. We will continue to be there for you!”

Once the sale purchase agreement has been signed, that’s when the work really begins. Because a solar or wind farm needs to be “taken care of”. We assist you with handling all business operations, from routine correspondence to financial accounting and ensuring that all ongoing contractual requirements and reporting obligations are met. We manage all interaction with energy suppliers, insurers, service providers and authorities to ensure the smooth operation of the project companies in line with all permits and licences.

Also in this phase, we are your exclusive contact – as a one-stop shop for the management of “your” asset.

Green technologies and sustainability funds

The funds we manage qualify as impact funds under Article 9 of the EU Sustainable Finance Disclosure Regulation (SFDR). Thus, they not only comply with the European investment guidelines in their core – as investments in renewable energy generation – but also in terms of their classification. This means that rather than being merely an empty shell, sustainability is now protected by explicit criteria.

Investors can thus rest assured in the knowledge that adequate standards of transparency and auditing are in place to assess compliance with the EU sustainability criteria. As endorsers of the principles of UNPRI and UN Global Impact, we see sustainability not only as a regulatory issue, but as a value in its own right. We generate added value for the solar and wind farms – for example through the sale of green power certificates – and act as continuous observers of the electricity market in order to leverage the potential that lies in climate protection.