With the growing share of renewable energies and increasing volatility in the electricity markets, the provision of flexibility and balancing services is becoming a decisive success factor for asset managers. “re:cap global investors”, an asset manager for renewable energies with a 1,4 GW portfolio, launched a corporate campaign in 2022 to prequalify wind and solar assets to balancing services.

The campaign, which is still ongoing, aims to identify opportunities offered by the flexibilization of renewable energy assets to generate additional revenues for our investors by participating in balancing services such as FCR, aFRR, and mFRR.

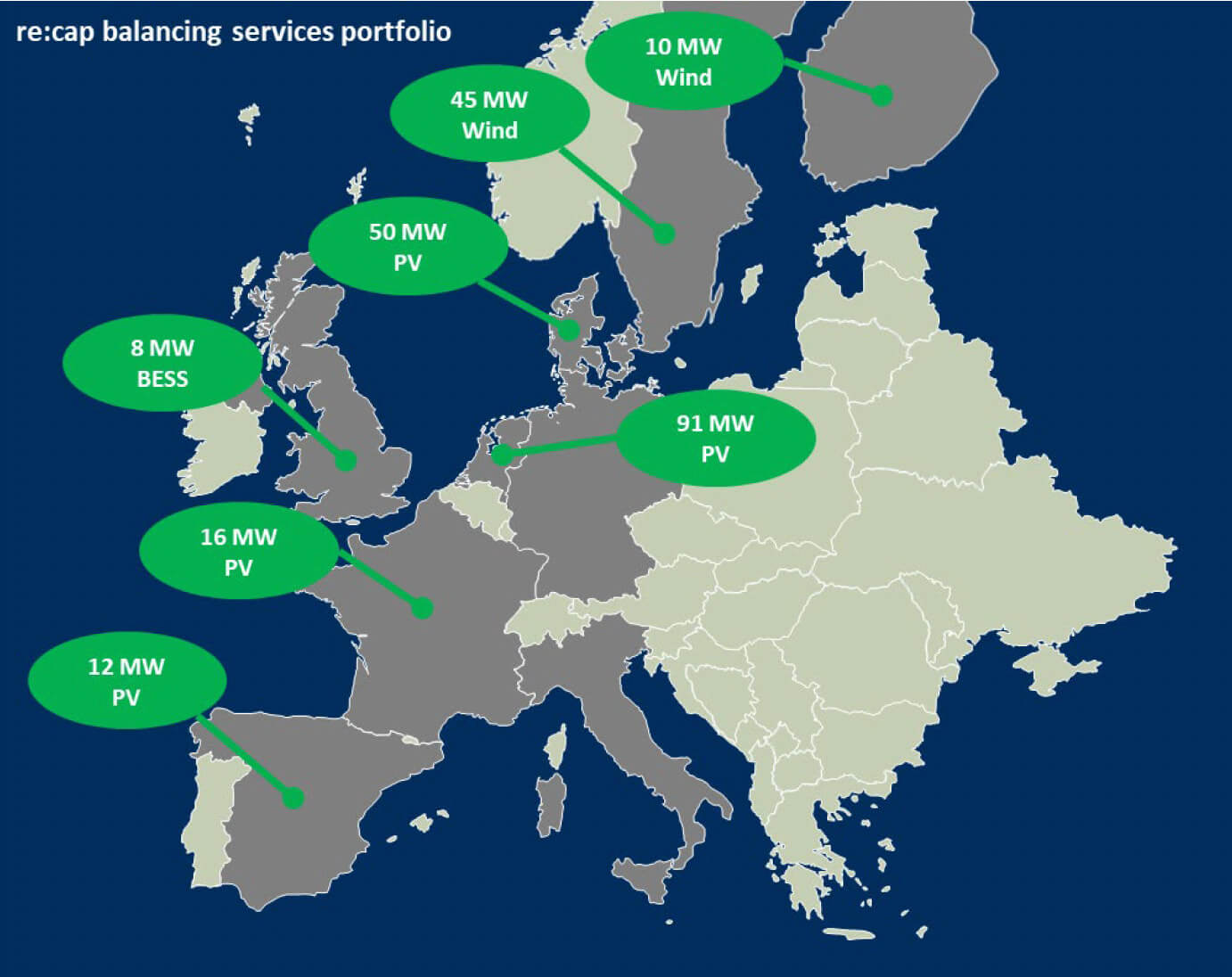

By mid-2025, assets with an installed capacity of 232 MW provide balancing services across Europe.

The price volatility on the European electricity markets clearly show: Flexibility is a key factor in the value creation of modern asset management strategies.

Focusing on balancing services

In the past, the focus for subsidized renewable assets was primarily set on traditional route-to-market agreements and price fixings via PPAs. Nowadays, however, the attention is shifting towards flexibility options and participation in balancing services.

One of the main reasons is the expansion of renewable energies that has led to a greater proportion of fluctuating electricity generation and thereby increasing the demand for short-term flexibility to ensure grid stability. At the same time, fluctuating electricity production is met with a comparatively inflexible consumer base. As a result, price spreads on the electricity markets are becoming more extreme and the number of hours with negative electricity prices is breaking records year after year. Asset managers are now faced with the challenges of flexibilization and optimizing their renewable energy portfolios on balancing markets. This involves actively managing the renewable assets to mitigate losses resulting from negative electricity prices, while simultaneously unlocking additional revenue streams for the investors.

Using flexibility to unlock additional revenues from renewable assets

The power grid cannot store energy – supply and demand must always be in balance. With the expansion of fluctuating renewables, the demand for balancing energy is increasing. Markets such as FCR (primary control reserve), aFRR (secondary control reserve), and mFRR (tertiary control reserve) offer the opportunity to monetize flexibility. However, participation in these markets requires investment in control technology and a willingness to operate assets flexibly.

Diversification across countries and technologies

re:cap pursues a strategy of diversification, offering balancing services not only from different technologies (wind, solar, battery) but also in various European markets. Experience gained from the prequalification of wind assets in Sweden (for FCR), as well as solar assets in Spain (for aFRR) and Denmark (for mFRR), demonstrate that, despite their inherently volatile electricity generation, renewable energy assets can make a significant contribution to grid stability. For example, re:cap successfully prequalified a wind farm for participation in the Swedish FCR market and the investment in control technology recouped in as little as two months, generating additional profits ever since. Furthermore, the participation of Danish and Spanish solar assets from the re:cap portfolio has shown that solar assets are also well-suited to providing balancing services.

Achieving success in the balancing market with experienced operators and power traders

To participate successfully in balancing markets, several critical prerequisites must be fulfilled. First and foremost, a comprehensive understanding of the individual balancing market regulations is essential, as requirements, activation protocols, and revenue opportunities differ markedly among FCR, aFRR, and mFRR. Furthermore, technical interfaces, particularly those facilitating data transmission and control, must be upgraded in close collaboration with the manufacturer and the technical manager of the plant. This ensures that plant can deliver high-frequency, real-time data and respond promptly and reliably to external control signals. During the operations, continuous and precise monitoring of plant performance is indispensable, as deviations from the scheduled electricity production, such as those resulting from technical malfunctions, may incur significant financial penalties.

Particularly noteworthy is the good cooperation with experienced power traders who accompany the technical conversion, integrate the plant into their balancing services pool, and ensure optimal dispatch of the plant through performance-based remuneration agreements.

All of the above necessitates a meticulously tailored balance services strategy for each renewable asset.

re:cap expands its electricity marketing expertise from PPA to flex trading

At re:cap, the PPA Advisory Board serves as the central hub of expertise for PPA portfolio management. To systematically harness the value of flexibility within re:cap’s portfolio, the board’s remit has been expanded to “Flex-Trading”. This extension focuses on conducting in-depth strategic analyses to identify which balancing markets, such as FCR, aFRR, mFRR, and which assets out of the managed portfolio offer the best participation opportunities.

Following this comprehensive evaluation, the PPA Advisory Board launched the balancing services campaign and oversees the technical and operational implementation.

Conclusion

The implementation of flexibilization and balancing services is a key factor in increasing the returns in renewable energy investments. Asset managers who actively enter this domain and invest in specialized expertise and advanced technologies can not only mitigate risks, such as revenue losses resulting from negative electricity prices, but also unlock significant additional profits for their investors.

Practical experience shows: Flexibility pays off, today more than ever!