In autumn 2021, the electricity prices in Germany for wind onshore and solar exceeded EUR 100/MWh for the first time. This was the starting point for re:cap to set up the internal “PPA Advisory Board” with the goal to generate additional value for investors through active PPA management and to reduce the risk of open electricity positions.

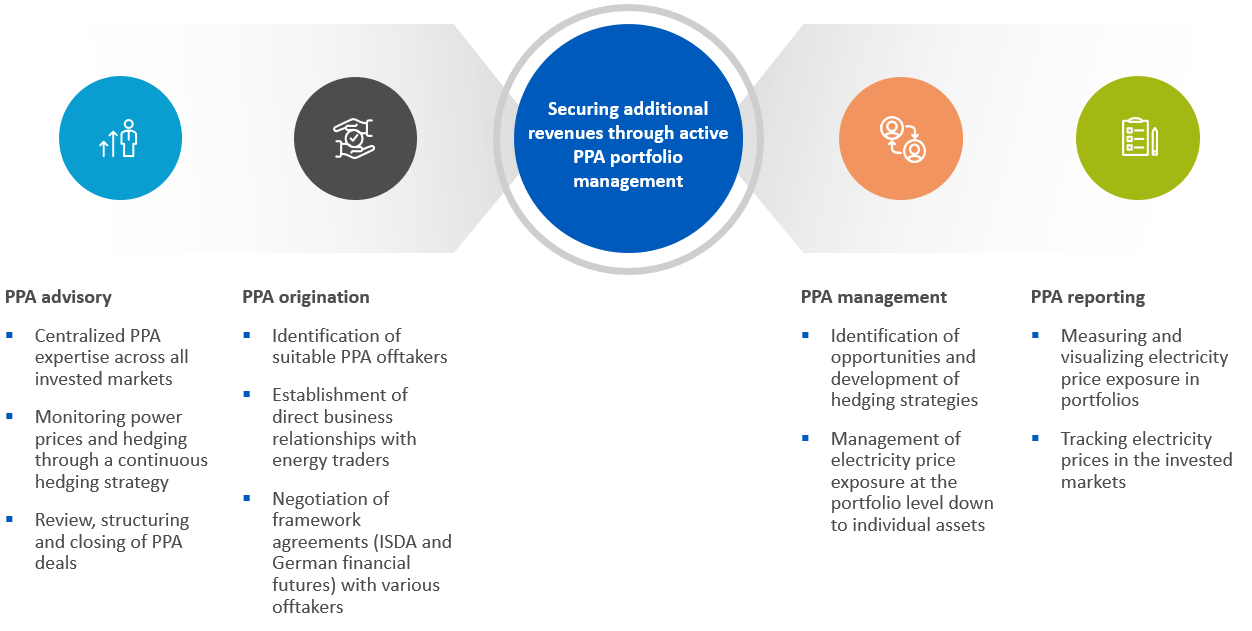

Fig. 1: Tasks of the PPA Advisory Board

Looking back

September 2021 will go down in history as the turning point of an unprecedented electricity price rally, which peaked in August 2022. On the futures market, the baseload calendar year 2023 in Germany was quoted at just under EUR 1,000/MWh.

The gas crisis, low power plant availability and severe drought led to unprecedented price distortions on the energy market across Europe from mid 2021 to early 2023. One of the main drivers of the energy price extremes was the low filling levels of European gas storage facilities. Because the electricity price on the commodities market is determined by the most expensive supplier – in this case gas-fired power plants – the high gas prices also led to rising electricity prices. It is particularly interesting that European gas storage facilities were filled to a level significantly below the average of previous years in preparation for the winter of 2021/22. With the war in Ukraine, the price increase since summer 2021 intensified further in February 2022 and ended with a peak in August 2022 after gas supplies from Russia via the pipeline Nordstream 1 were halted. The scarcity of power supply was exacerbated by the reduced availability of coal-fired power plants due to limited coal deliveries by ship as a result of the low water levels in rivers such as the Rhine due to excessive drought. Electricity prices finally recovered when gas storage facilities in Europe were almost completely filled, also partly due to additional LNG deliveries, in combination with a mild weather outlook for the winter of 2022/23.

Hedging forward market prices via PPA price fixing

Asset managers with renewable plants commissioned under the German renewable energy act (EEG) never had to manage the electricity positions because, on one hand, the EEG plants have a guaranteed injection right , and on the other hand, through the EEG the plants are subsidised with a fixed feed-in tariff (“Anzulegender Wert” or “AW”) in EUR/MWh via the market premium mechanism.

At the end of 2021, when the monthly market values but also the electricity prices on the futures market were above the AW for many projects for the first time, the door was opened to a previously unknown area of energy trading for Asset Managers with a portfolio of subsidised renewable plants. At such high electricity prices as we have seen the last couple of years, the AW forms a price floor, and it makes sense to hedge the electricity position opportunistically on the futures market instead of just letting it realise via the monthly market values.

This is where the “PPA Advisory Board” comes into play. This board pools the expertise for electricity hedging within re:cap with the aim to generate additional revenues through active PPA portfolio management in the short or long term. Since the launch end of 2021, we have concluded wind and solar PPA price fixings with a volume exceeding 1,155 MW for the delivery years 2022 and 2023 in Germany, the Netherlands, France, Denmark and Spain. We are thus generating significant additional income for our investors, which strengthens the attractiveness of renewable assets as an investment vehicle for investors.

Fig. 2: Selection of some PPA price fixings

Citations

Reference Fig. 2 Baseload Prices: Montel